Why Didn’t You Let Me Know?

A recent case in the Fair Work Commission (FWC) has reinforced the importance of employers understanding and complying with the consultation provisions in their industrial instruments when undertaking major workplace change.

It also makes clear, that failure to do so, can result in a termination that arises from that workplace change being found to not be a genuine redundancy under the Fair Work Act 2009 (Cth) (Act) because the employer has failed to comply with the applicable consultation requirements.

The background

The case in question relates to a Financial Data Analyst working for a not for profit organisation. The employee was hired in August, 2022.

In May, 2023 the organisation commenced conversations with the employee regarding a possible change in job title and provided a draft job description. A month later, the employee was told everything was on hold because of the appointment of a new Chief Information Officer (CIO) and that any changes needed to align with the CIO’s plan for the Business Intelligence Department.

Between July 2023 and October 2023, the CIO reviewed the structure and performance of the Business Intelligence Department. On 17 October 2023, the CIO sent an email to the Head of Data Analysis & Reporting and other Executives confirming that amongst other structural changes the position of Financial Data Analyst was “too narrow in scope and skill set, and so would be made redundant in the new structure.”

Six days later on 23 October, 2023 the CIO and Head of Data Analysis and Reporting met with the employee to inform him of the company’s decision to make his role redundant. This was followed by meetings on 1 November and 8 November 2023, where the employee unsuccessfully applied for an alternative position of Senior Data Analyst, resulting in his termination on 8 November, 2023. The employee subsequently lodged an unfair dismissal claim.

The decision

Upon reviewing the entire sequence of events between May and October 2023, the FWC found that the company had decided to review and restructure the Team as early as June 2023 but had not communicated this decision to the employee until 23 October 2023.

Whilst the FWC found that there were operational requirements that led to the company making the role of Finance Data Analyst redundant, it also found that the termination was not a genuine redundancy because the employer had failed to comply with the applicable consultation requirements under its own Enterprise Agreement. One of the requirements of the Act is for the employer to comply with any obligation in a modern award or enterprise agreement that applied to the employee’s employment requiring prior consultation about redundancy.

The FWC determined that the company should have consulted with the affected employee as reasonably practicable after the decision was made to initiate a structural review which could have resulted in a significant impact for the employee.

The FWC found that the CIO had consulted with “other leaders” on how to plan and effect the restructure, and that he had met with many others in the senior management team to understand what skills and experience were required in the Business Intelligence Department moving forward. The FWC said that the CIO had consulted with almost everyone except for the impacted employee.

In its decision, the FWC stated that the purpose of consultation requirements is to allow affected employees the opportunity to participate in the process and have a say in decisions and actions that may significantly impact them once a decision has been made to take action or introduce major changes. This is required before an employee is terminated. Consultation was not simply informing an employee that they were to be made redundant several months after the decision to restructure their team had already been made.

Having found that the dismissal was not a genuine redundancy, the FWC awarded the employee a gross payment of $7,452. This equated to three weeks’ pay, which is the amount of additional time it would have taken for the company to properly comply with the consultation requirements under their Enterprise Agreement.

Connect with us

If you would like more information on how to comply with consultation provisions in your industrial instrument, please contact us to see how we can support you and your organisation!

Recent changes to the Fair Work Act 2009 (Cth) (‘FW Act’) and modern awards from 1 July 2024 have introduced significant rights for workplace delegates to represent members of their union including communication with members in work time, access to the workplace and workplace facilities, and access to training.

These changes will affect workplaces where there are currently no workplace delegates, but they will also have potential application to workplaces where arrangements for workplace delegates are already in place.

Who can be a workplace delegate?

A workplace delegate is a person appointed or elected, in accordance with the rules of an employee organisation, to be a delegate or representative (however described) for members of the organisation who work in a particular enterprise. In essence, a workplace delegate is an employee who is a representative of their union at the workplace.

Representation

A workplace delegate may represent the industrial interests of eligible employees who wish to be represented by the workplace delegate for matters including:

- consultation about major workplace change;

- consultation about changes to rosters or hours of work;

- resolution of disputes;

- disciplinary processes;

- enterprise bargaining where the workplace delegate has been appointed as a bargaining representative or is assisting the delegate’s organisation with enterprise bargaining; and

- any process or procedure within an award, enterprise agreement or policy of the employer under which eligible employees are entitled to be represented and which concerns their industrial interests.

Reasonable communication

A workplace delegate may communicate with eligible employees for the purpose of representing their industrial interests, including discussing membership of the delegate’s organisation and representation with eligible employees. A workplace delegate may communicate with eligible employees during work hours or work breaks, or before or after work.

Reasonable access to the workplace and workplace facilities

An employer is required to provide a workplace delegate with access to or use of the following workplace facilities:

- a room or area to hold discussions that is fit for purpose, private and accessible by the workplace delegate and eligible employees;

- a physical or electronic noticeboard;

- electronic means of communication ordinarily used in the workplace by the employer to communicate with eligible employees and by eligible employees to communicate with each other, including access to Wi-Fi;

- a lockable filing cabinet or other secure document storage area; and

- office facilities and equipment including printers, scanners and photocopiers.

However, the employer is not required to provide access to or use of a workplace facility if:

- the workplace does not have the facility;

- due to operational requirements, it is impractical to provide access to or use of the facility at the time or in the manner it is sought; or

- the employer does not have access to the facility at the enterprise and is unable to obtain access after taking reasonable steps.

Reasonable access to training

An employer, who is not a small business employer, is required to provide a workplace delegate with access to up to five days of paid time during normal working hours for initial training and at least one day each subsequent year, to attend training related to representation of the industrial interests of eligible employees.

However, paid training is subject to the following conditions:

- in each year commencing 1 July, the employer is not required to provide access to paid time for training to more than one workplace delegate per 50 eligible employees; and

- the number of eligible employees is to be determined on the day a delegate requests paid time to attend training. Eligible employees are those who are full-time or part-time employees, or regular casual employees.

Payment for a day of paid time during normal working hours is payment of the amount the workplace delegate would have been paid for the hours the workplace delegate would have been rostered or required to work on that day if the delegate had not been absent from work to attend the training.

Exercise of Delegates’ Rights

A workplace delegate is subject to the following conditions when exercising their rights:

- comply with their duties and obligations as an employee;

- comply with the reasonable policies and procedures of the employer, including reasonable codes of conduct and requirements in relation to occupational health and safety and acceptable use of ICT resources (presumably meaning information and communications technology);

- not hinder, obstruct or prevent the normal performance of work; and

- not hinder, obstruct or prevent eligible employees exercising their rights to freedom of association.

Key takeaways

The FW Act provides that the employer must not:

- unreasonably fail or refuse to deal with a workplace delegate; or

- knowingly or recklessly make a false or misleading representation to a workplace delegate; or

- unreasonably hinder, obstruct or prevent the exercise of the rights of a workplace delegate under the FW Act or the delegates’ rights clause.

The delegates’ rights provisions place onerous obligations on employers to support and pay for delegates to conduct union business at the workplace including during work hours. The risks for employers that do not manage their obligations to workplace delegates are potentially significant.

Connect with us

If you would like to know more about delegates’ rights, please contact us and a Mapien Workplace Strategist will be in touch within 24 hours.

This is blog #10 in our series on coaching models. Sign up to our mailing list to make sure you don’t miss out on our future content.

Are you confident in your ability to deliver feedback in the workplace?

Feedback can be a powerful tool for motivation, engagement, growth, wellbeing, satisfaction, development, and organisational performance. But it can have a positive or negative impact, depending on the type of feedback and how it is delivered.

As a leader, delivering feedback in the best possible way will benefit your colleagues — and your organisation as a whole. We’ve got a coaching model (and some practical tips) to help you make the most of every opportunity to share feedback.

Introducing the Feedback Bridge

You might’ve heard of The Feedback Sandwich (or hamburger), which involves sandwiching constructive criticism in between positive feedback. But there’s another feedback model you may not have heard of: The Feedback Bridge!

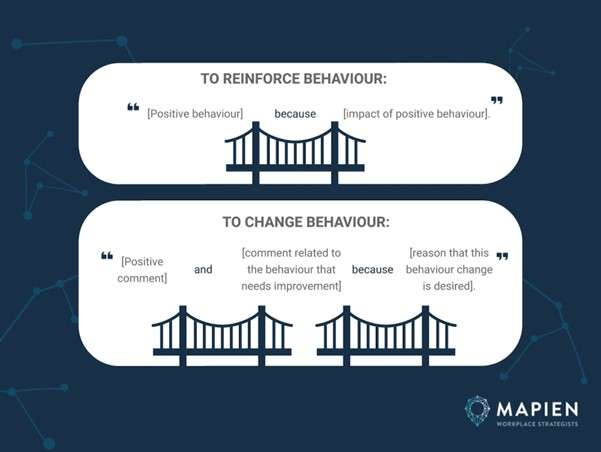

The Feedback Bridge helps to structure your conversations when giving feedback — whether you want to reinforce positive behaviours or encourage a shift in behaviour.

It helps you, the feedback-giver, to build a bridge between the current situation and the desired future situation. And ideally, it also helps to build or reinforce the connection between yourself and the feedback recipient.

If you’re not yet confident on how to give feedback, it’s the perfect place to start.

How to apply the Feedback Bridge

The Feedback Bridge can be used to plan your conversation ahead of time, ensuring that you touch upon key points of feedback and insight in a way that’s effective, considerate, and most likely to have the desired effect. We’ve broken this method down into four key steps, along with some examples.

Step 1: Identify behaviour & reflect

The first step is to identify the behaviour you’d like to focus your feedback on. It could be positive behaviour that you want to reinforce, or unwanted behaviour that you want to encourage them to change. We’ve included one example of each below:

| Behaviour Example | |

| Positive Behaviour | Going out of their way to collaborate with other teams. |

| Negative Behaviour | Frequently showing up late or unprepared for meetings. |

Step 2: Consider the impact & keep it positive

Whether you’re planning to reinforce a positive behaviour or change a negative behaviour, you’ll need to address why you wish to encourage or change the behaviour. Reflect on what the impact of that behaviour is and how you’ll bring that up in conversation. For example:

| Behaviour Example | Impact | |

| Positive Behaviour | Going out of their way to collaborate with other teams. | This helps build capabilities and knowledge, reinforces our sharing culture, and strengthens relationships within our organisation. |

| Negative Behaviour | Frequently showing up late or unprepared for meetings. | This makes others feel disrespected and wastes their time. It also doesn’t accurately reflect your abilities as a professional. |

Note: if your feedback will be focused on changing an undesired or negative behaviour, there’s an extra step involved. You should start with a positive comment (that’s relevant to the situation) with your feedback. This will help to:

- Keep your perspective balanced and focused on the big picture (it’s not all bad!)

- Soften the blow of any negative points you’re about to share

- Prepare the recipient to be open to critical feedback

- Boost the recipient’s self-esteem and motivation

In the negative behaviour example shown above, you might like to start with one of the following positive comments:

|

Step 3: Fill out the Feedback Bridge

To complete your preparations, write down everything from steps one and two, following the structure of The Feedback Bridge. Note how each of your comments should be connected by words like “because” or “and” — this links your feedback to the reasons behind it.

You might like to recreate a simple version of The Feedback Bridge to fill out, or copy-paste the following templates:

Reinforcing positive behaviour

| Positive Behaviour | Impact of Positive Behaviour | ||

| ______________________________________ | because | ______________________________________ | |

| ______________________________________ | ______________________________________ | ||

| ______________________________________ | ______________________________________ | ||

| ______________________________________ | ______________________________________ | ||

Changing negative behaviour

| Positive Comment | Behaviour That Needs Improvement | Why Change is Desired | ||||

| _______________________ | and | _______________________ | because | _______________________ | ||

| _______________________ | _______________________ | _______________________ | ||||

| _______________________ | _______________________ | _______________________ | ||||

Step 4: Share your feedback

Finally, it’s time to share your feedback with the intended recipient, ensuring you follow The Feedback Bridge structure to deliver your comments.

For more serious or formal feedback, you should schedule a one-on-one catch up, ideally face-to-face. But if the feedback is more casual in nature, a more informal approach may be more appropriate (in fact, scheduling a meeting could cause unnecessary anxiety!).

We share more about this topic in our previous blog, Workplace Communication: Choosing The Right Communication Channel.

6 tips and principles for effective feedback

In addition to using The Feedback Bridge, we’ve got some additional tips and principles that can help make your feedback more effective and constructive.

Have a clear why

Research suggests that your perceived intent can have an impact on how the recipient reacts to your feedback. So, ask yourself what you want to achieve from the conversation and make your reasons clear from the start. Most importantly, ensure your feedback is focused on benefitting the recipient.

Make it specific

Feedback that is general in nature probably won’t help the recipient and might even confuse them. The feedback you share should be specific and concrete, just like the S.M.A.R.T.(S) goal setting framework we covered previously.

Make it actionable

Your feedback should also be focused on something the recipient can take action on. After all, there’s few things more frustrating than getting criticism about something you cannot control or change.

Keep it positive

One of the reasons we like The Feedback Bridge framework is because it can be used to enforce positive behaviour, and it incorporates positive comments even when change is desired.

When you’re quick to praise and reinforce positive behaviours, you can directly impact efficiency and effectiveness. And one of the best things you can do is praise the effort people put into their work.

Ask for feedback in return

“Feedback is a free education.”

As a leader, you can model how you want your team to receive feedback and respond to criticism. So, if you don’t already have a feedback mechanism in place for your leadership, create one. Ask for feedback and prepare to gain some insights into your own behaviour as you work towards becoming a better leader.

Build your feedback muscle

If giving and receiving feedback feels tricky right now, it might be because you need to do it more often.

Recently, McKinsey shared about a new initiative to encourage their teams to practise having feedback conversations via structured “challenges” delivered over a four week period. Their goal was to help people get comfortable asking for, reflecting on, and taking action on feedback. This initiative resulted in 250 feedback conversations that would otherwise not have happened, and they received many positive comments from those involved.

The takeaway? You can build your feedback muscle over time by simply sharing and requesting feedback on a regular basis!

Explore other methods

There are various other methods for providing feedback to others, and different models may even be better suited to your context or purpose better than The Feedback Bridge. As a starting point, we recommend exploring:

- The Feedback Sandwich

- The Situation-Behaviour-Impact (SBI) Feedback Model

- The Example-Effect-Change/Continue (EEC) Feedback Model

- The Describe-Express-Specify-Consequences (DESC) Feedback Model

Plus, many of the leadership and coaching models we’ve shared previously are useful tools for reflection, behavioural change, and personal development. Take a look at Stealth Expectations, The Circles of Control, Influence & Concern, The GROW Coaching Model, The Stages of Change Model, and The Choice Point Method.

Get support

Looking for support with workplace psychology or more hands-on support for your leadership team? Contact our team to start the conversation today!

As we head into the new financial year, we’re excited to celebrate our latest Mapien promotions, and share some exciting updates in our Workplace Strategy leadership team.

Dr Leith Middleton | Specialist Group Lead - Psychological Health and Safety - National

Dr Leith Middleton has been leading psychological health and safety projects at both strategic and team intervention levels and has expert knowledge on complex people issues such as psychological health and safety, mental health, and human resource challenges.

We’re thrilled to announce Leith’s promotion to Specialist Group Lead – Psychological Health and Safety – National. Congratulations Leith!

Bridget O'Connor | Principal Consultant

With her composed manner and high-level technical capabilities, Bridget O’Connor provides expert strategic guidance and advice to clients in relation to their industrial relations and employment needs.

Congratulations Bridget on your well-deserved promotion to Principal Consultant!

Mapien's Leadership Updates

We’re excited to share some changes to our leadership structure in the new financial year.

Dr Joshua Shingles | Head of Workplace Strategy – Eastern Region

Dr Joshua Shingles will now take on responsibility for our QLD and NSW operations, in the role of Head of Workplace Strategy – Eastern Region. Congratulations Joshua!

Jamie Paterson | Head of Workplace Strategy – Southern Region

Jamie Paterson will oversee our Melbourne, South Australian and Tasmanian operations, as our Head of Workplace Strategy – Southern Region. We’re excited to see Jamie to continue to grow our Southern operations!

Mark Brady |Head of Workplace Investigations & Public Sector – National

Mark Brady will expand his role to Head of Workplace Investigations and Public Sector – National. This change recognises Mark’s leadership and specialisation in Workplace Investigations – congratulations Mark.

Connect with us

Need prompt and practical advice? Please contact us and one of our Workplace Strategists will be in touch within 24 hours.

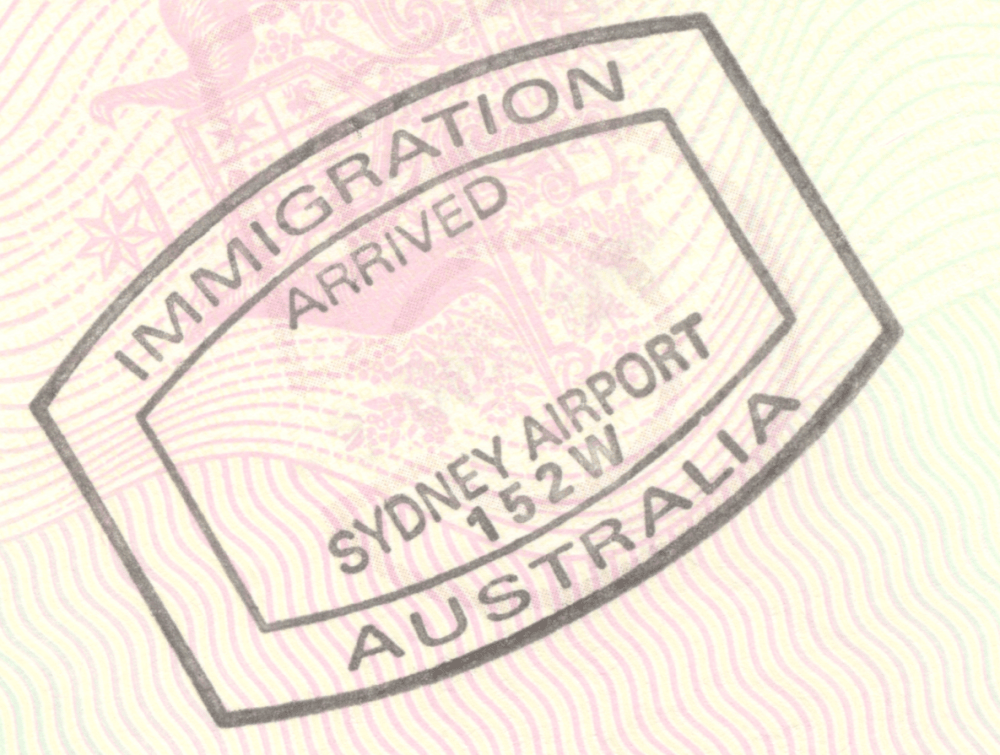

Be Prepared – A reminder of the visa changes for 1st July 2024

As we enter into the last week of June, below is a reminder of the changes taking effect from the 1st July 2024 specific to the employer sponsored visa categories – Subclass 482, 494 and 186 visa. Please read the below updates so you are prepared for the changes.

Timeline of Changes - 1st July

- Fee Increases

- TSMIT Increase

- Change to 482 and 494 visa conditions

- Age Concession will end 30th June 2024

November 2024

- Reduction of work experience requirement for Subclass 482 visa

Implementation late 2024

- Develop new Skills in Demand Visa

- Develop a specialist skills pathway to drive innovation & job creation

- Develop a core skills pathway to meet targeted workforce needs

Fee Increases

The Government lodgement fees for most subclasses of visa will increase on the 1st July. The fees are expected to increase by around 2 % to 3 %. We will share the new fees as they become available.

Increase to the Temporary Skilled Migration Income Threshold (TSMIT)

From 1st July 2024, the TSMIT will increase from $70,000 to $73,150.

New nomination applications (Subclass 482, 494 and Subclass 186) lodged from the 1st July 2024 will need to meet the new TSMIT of $73,150 or the annual market salary rate, whichever is higher.

This change will not affect existing visa holders and nominations lodged before the 1st July 2024.

Change to the 482 and 494 visa conditions

As part of the continued visa overhaul, the Department has announced that the following visa conditions will change for visa holders of the subclass 482 and 494 visas on 1st July: Conditions: 8107, 8608 and 8607.

These conditions currently state that you must only work for your sponsoring employer in your nominated occupation and if you cease employment it cannot be for more than 60 days.

These visa holders (subclass 482 and 494) will now have 180 days at a time or 365 days in total across the entire visa grant period, to find a new employer to sponsor them, trial with a new employer before a nomination transfer/visa application, lodge another type of visa or leave the country.

As well as granting the visa holder more time to find a new employer, the Department will also allow the visa holder to work for other employers and work in occupations not listed on their most recent nomination approval.

Sponsoring employers are still required to make the cessation notification to the Department within 28 days. This obligation has not changed.

These conditions apply to existing visa holders as well as new.

Age Concession Cessation

As part of the Governments plan to allow temporary visa holders a pathway to PR, the age concession was available to those who:

From 1 July 2022 to 30 June 2024, are eligible legacy subclass 457 visa holders who can access the TRT stream. To be eligible the visa holder must:

- have held a subclass 457 visa on or after 18 April 2017

- have been in Australia between 1 February 2020 and 14 December 2021 for at least one year

- meet all other nomination and visa requirements

This allowed visa holders over the age of 45 years to apply for a Subclass 186 visa under the TRT pathway. This pathway closes on the 30th June 2024 to this visa cohort.

To apply for a subclass 186 using the current age concession in place you must:

- Have worked for your sponsoring employer for two years while holding the subclass 482 visa, and;

While earning the Fair Work High Income Threshold (FWHIT) for those two years.

Changes to be implemented late 2024

To be eligible for a subclass 482 visa, the visa holder must have at least two years of full time work experience in the last five years post qualification.

The Department announced that from 23 November 2024, a reduction to the work experience requirement for the TSS subclass 482 visa from two years of experience to one year.

This change is most welcomed especially for those visa holders whose visas are expiring at the end of the year and where they are still short that two years required for the 482 visa.

The Government is also working to develop a new skills in demand visa which will replace the subclass 482 visa. This visa will have a three tiered approach focusing on a new specialist pathway to attract highly skilled workers; a core skills pathway to meet targeted workforce needs and those who work in our community such as aged care workers, child care workers, manufacturing and hospitality.

Consultations are currently underway for the core skills pathway with review of the occupation lists.

Labour market testing is also being reviewed, with the first changes that happened last year where the need to advertise on Workforce Australia was removed. The Government will look to make the LMT less complicated and implement a four to six month validity late 2024.

Currently the requirement is that the sponsor has advertised in two locations, for a period of 28 days, where the adverts are no older than four months prior to nomination lodgement.

We welcome these LMT changes.

Takeaways

This is going to be a year of change with the Government undertaking thorough research on the labour market as it starts to form the policy settings for the new Skills in Demand Visa.

Please ensure you are ready and are reviewing your current temporary visa holder employees.

If you need immigration advice or assistance please always reach out to our Mapien team, we are here to help.

Department of Home Affairs Announcement

As part of the visa overhaul announced last year, the Department of Home Affairs have announced that from the 1st July 2024 the following visa conditions will change for subclass 457, 482 and 494 visa holders:

⭐️ Condition 8107, 8607, and 8606

These conditions currently state that you must only work for your sponsoring employer in your nominated occupation and if you cease employment it cannot be for more than 60 days. These visa holders would also be required to find a new employer to take over their visa by completing a nomination transfer within that 60 day period.

The announcement has confirmed that due to some worker exploitation over the years, DOHA will relax these conditions to allow these visa holders to easily move between sponsors.

- These visa holders who hold the above visas who stop working with their sponsor will be given more time to find a new sponsor, apply for a different visa or depart Australia.

- These visa holders will now have 180 days at a time or 365 days in total across the entire visa grant period.

- As well as DOHA granting more time to find a new sponsor visa holders will also be able to work for other employers and work in occupations not listed on their most recent nomination approval. A most generous change by the Department and one that I am nervous about albeit glad to see the flexibility for those who need more time to find a new sponsor and work to support their families while they search for new employment.

- Sponsoring employers are still required to make notification to DOHA within 28 days of cessation of employment.

- These conditions apply to existing visa holders as well as new.

Only time will tell on how this will all unfold particularly for employers where the visa holder can now more freely visa hop. Good news those for new employers where they can trial the visa holder before they complete the visa process.

Connect with us

For more information and immigration advice, please as always, reach out to us at Mapien.

Timely Payment of Employee Entitlements Post-Termination

A recent Federal Court decision, Dorsch v HEAD Oceania Pty Ltd (Penalty) [2024] FCA 484, has highlighted the importance of timely payment of employee entitlements after termination. This case sets a crucial precedent for employers, emphasising that delays in payment can lead to significant penalties.

Case Background

The case involved an employee who received payment for their accrued but untaken annual leave three months after being terminated. The Federal Court found that this delay violated section 90(2) of the Fair Work Act (FW Act), which requires such payments to be made on the day of termination. The employer was fined $17,000 for this breach, representing about 25% of the maximum penalty. Additionally, the employee was awarded $10,000 in general damages due to the distress caused by the financial strain from the delayed payment.

Key Points for Employers

Timely Payment of Entitlements: The Fair Work Act mandates that all amounts payable to an employee must be paid in full and at least monthly. However, the Federal Court clarified that accrued but untaken annual leave must be paid out on the day of termination.

Legal Obligations: Employers must be aware of their obligations under the FW Act. Ignorance of the law is no excuse. The Court emphasised that employers must understand and comply with their legal responsibilities to avoid penalties.

Procedural Fairness: When terminating an employee, employers must follow procedural fairness. This includes providing written notice of termination, where applicable, stating the effective date and ensuring all owed entitlements are paid promptly on termination day. These entitlements include outstanding wages, notice payments, accrued annual leave, long service leave, and redundancy pay, if applicable.

Legal Implications

The Federal Court’s decision in this case aligns with another ruling on payment in lieu of notice. According to section 117(2)(b) of the FW Act, payment in lieu of notice must be made before the dismissal takes effect. This clarifies that both notice payments and accrued entitlements must be settled on the termination day to ensure lawful termination.

Ensuring Compliance

To comply with the FW Act and avoid penalties:

- Understand Your Obligations: Familiarise yourself with the FW Act and any applicable awards or agreements. This includes knowing when and how to make required payments.

- Seek Expert Advice: If unsure about any entitlements or legal requirements, seek advice from legal or HR experts to avoid mistakes.

- Follow Best Practices: Ensure all termination processes are fair and transparent. Provide written notice and make all required payments on the termination day.

Conclusion

The Dorsch v HEAD Oceania Pty Ltd case is a critical reminder for employers about the importance of timely payments of entitlements upon termination. By understanding and adhering to legal obligations, employers can avoid significant penalties and ensure fair treatment of their employees.

Connect with us

If you would like more information or want to learn more, please contact us here and a Mapien Workplace Strategist will be in touch ASAP.

The classic line from the movie When Harry Met Sally sums up human behaviour. We always want what others around us have.

Having sat through countless Enterprise Agreement negotiations, I have faced regular claims from unions to include a ‘labour hire clause’ in the Agreement. The long-held view of most employers has been to push back on that notion, with the business lens of having the flexibility to bring in labour hire to subsidise an employee workforce when required, and for the commercial arrangement around pay rates for labour hire employees being something that was not part of discussions. This has all changed.

The Fair Work Legislation Amendment (Closing Loopholes) Act 2023 has brought about significant changes to the Australian employment landscape, particularly the amendment associated with same job, same pay requirements for both employers and labour hire organisations. This amendment aims to ensure that labour hire employees are remunerated at the same rate that the employees of the host employer are paid if they are performing the same role.

Under the new legislation, employers and labour hire organisations are now required to pay employees equally for performing the same job. This means that workers hired through a labour hire organisation must receive the same wages, entitlements, and working conditions as their counterparts who are directly employed by the host company.

Lessons for Employers

Calculate the rates

As this piece of legislation has played out, it has proven difficult to calculate and compare the rates of pay between labour hire and host employer employees. In a recent matter (“Automotive, Food, Metals, Engineering, Printing and Kindred Industries Union” known as the Australian Manufacturing Workers’ Union (AMWU) (188V) v Paper Australia Pty Ltd T/A Opal – [2023] FWC 2129 | Fair Work Commission) the union claimed that the wages and conditions paid to labour hire employees was not equal to those paid to employees of the host employer. In this instance the employer was able to successfully argue that all entitlements (allowances, bonus and higher overtime rates) resulted in the labour hire employees being paid at least what the host employer’s employees are paid. Regardless of the outcome of this matter, it demonstrates that calculating the wages and conditions is not simple.

Compliance is key

It is essential for employers, both labour hire and host employers, to review their current employment practices and contracts to ensure they are in line with the new legislation. Both labour hire and host employers have responsibility to ensure that payment terms are understood and are applied equally. Failure to comply with the same job, same pay requirements could result in costly penalties and legal action.

Transparency is crucial

Employers should be transparent about the wages, entitlements, and working conditions offered to both host employees and labour hire employees. Clear communication and fairness in remuneration are vital to maintaining trust and morale among workers but is also vital for employers to meet their requirements under this amendment.

Proactive approach

Employers should proactively engage with labour hire organisations to ensure that both parties are aware of their responsibilities under the new legislation. Regular monitoring and review of employment practices can help prevent any potential breaches and ensure compliance.

Closing Loopholes

The Fair Work Legislation Amendment (Closing Loopholes) Act 2023 could potentially see an end to the union claim for ‘labour hire clauses’ in Enterprise Agreements, but the requirement to ensure same job, same pay is happening sits firmly with employers.

Setting it as part of legislations, means that Employers must take proactive steps to ensure compliance, with the risk of civil penalties against both host employers and labour hire employers for such things as breaches to ‘anti-avoidance’ provisions.

Connect with us

If you would like more information or want to learn more, please contact us here and a Mapien Workplace Strategist will be in touch ASAP.

The Fair Work Commission’s Expert Panel has awarded a 3.75% increase to the National Minimum Wage and the minimum wages in Modern Awards.

Accordingly, the National Minimum Wage will be increased to $915.90 per week or $24.10 per hour and all Modern Award minimum weekly wages will be increased by 3.75% from the first full pay period commencing on or after 1 July 2024.

Application of the Increase to the National Minimum Wage and Modern Awards

The increase applies to minimum wages for all employees, including junior employees, trainees, apprentices, supported wages and piece rates. Weekly wages will be rounded to the nearest 10 cents.

If an Enterprise Agreement applies to an employee and the employee would otherwise be covered by a Modern Award, then the employee’s base rate of pay under the Enterprise Agreement must not be less than the base rate of pay that would be payable to the employee under the Modern Award.

If an Enterprise Agreement applies to an employee and the employee is not covered by a Modern Award, then the employee’s base rate of pay under the Enterprise Agreement must not be less than the National Minimum Wage.

If no Enterprise Agreement or Modern Award applies to an employee, then the employee cannot be paid less than the National Minimum Wage.

What factors did the Panel consider?

The Panel advised that key factors from current economic circumstances presented clear guidance for this year’s Decision. These factors include living standards, the needs of low paid Australians, workforce participation and striving for gender equality. The Panel further noted that lower inflation, no real change to labour productivity and a relatively strong labour market and profit growth in a majority of sectors, were also key considerations in reaching this year’s Decision.

The Panel also highlighted their consideration of upcoming cost of living relief which will directly assist those employees who are reliant on Modern Award wages. These measures include upcoming tax cuts, increase to minimum superannuation contributions from 11% to 11.5% and other proposed measures, such as the Energy Bill Relief Fund.

The Panel confirmed that this year’s Decision is broadly aligned with forecasted wage increases across the general market and expected lower inflation in 2025.

The Panel indicated that approximately 20.7% of employees in Australia are paid in accordance with Modern Award wages, with four key sectors heavily reliant on these wages. The four key industry sectors which contain the largest proportions of modern award reliant employees are Accommodation and food services, Health care and social assistance, Retail trade and Administrative and support services. The Panel reiterated, as they have done in previous years, that typically these employees work part-time or casual hours and are predominantly female.

In accordance with their commitment to addressing gender equity in the Australian workforce, the Fair Work Commission announced the successful completion of their research into gender undervaluation which has brought to light various priority areas. Specific employees highlighted in these priority areas included early childcare workers, disability home care and other social care employees, and medical support professions, such as dental assistants, psychologists and pharmacists. The Panel confirmed that by next year’s Annual Wage Review Decision, they will have undertaken proceedings to address gender undervaluation and will provide further guidance at that time.

Interested to learn more?

If you would like more information on the impact that the minimum wage increase might have to your organisation, please contact us here and a Mapien Workplace Strategist will be in touch ASAP.

Increase to the Temporary Skilled Migration Income Threshold (TSMIT)

From 1st July 2024, the TSMIT will increase from $70,000 to $73,150.

New nomination applications (Subclass 482 and Subclass 186) lodged from the 1st July 2024 will need to meet the new TSMIT of $73,150 or the annual market salary rate, whichever is higher.

This change will not affect existing visa holders and nominations lodged before the 1st July 2024.

Budget update – the main changes

Following a massive net overseas migration intake of 528,000 in 2022/2023, it is predicted that net overseas migration will drop to 395,000 in 2023/2024 and further in 2024/2025 to 260,000.

The migration planning levels are assessed on a yearly basis, from 2025/2026 these planning levels will be set for a four year period, allowing transparency for better long term forecasting.

- Permanent Migration program will be capped at 185,000 places for the 2024/2025 year, with 132,000 places allocated to the skilled stream, and 52,500 allocated to the family stream, the bulk of which will be available for the partner visa stream (40,500)

- $18.3m investment over four years for further reform to drive economic prosperity and restore the integrity of Australia’s visa program.

Visa Changes

It was announced that the following visa changes will be happening in the new financial year.

- A new national innovation visa to replace the current Global Talent Visa.

- TSS Visa Changes – a reduction to the work experience requirement for the TSS subclass 482 visa from two years of experience to one year. This will take effect towards the end of November 2024.

- A new professional visa for Indian Nationals paving a pathway for 3,000 graduates with specific knowledge and skills, allowing them to work in Australia for up to two years.

- A new ballot process for the Work and Holiday Visa program for China, Vietnam and India, for FY25.

The Migration Strategy

The Governments vision is to get migration working for the nation, helping deliver a prosperous and secure Australia.

The first comprehensive review of the migration system in May 2023 found that the system was broken, and that there was a lack of clarity on what Australia was trying to achieve through migration. The Government is focusing on having a better planned migration system that works for the nation, aiming to strengthen the community and improve the standard of living.

The Governments five core objectives under this review are:

- Better living standards for all – Meeting skills shortages: Migration is not a substitute to replace Australian employees or not to train Australians permanent residents or citizens.

- A Fair Go for all – Pro Wages: Build secure jobs for all with better working conditions preventing migrant worker exploitation

- Building a stronger Australian Community: Moving away from temporary residency (TR) to permanent residency so those TR visa holders are not continually living in limbo

- Strengthening International relationships: Building stronger economic and social connections with international partners (APAC)

- Making the system work: Make if fast and efficient

These objectives will ultimately lead to a new and better working migration program, replacing the Subclass 482 with the Skills in Demand Visa later in the year.

Consultation on draft new core skills occupation list (CSOL)

The Jobs and Skills Australia (JSA) are responsible for undertaking labour market analysis and stakeholder engagement to assist the Government with final decisions on the new CSOL, ensuring that our temporary skilled migration program is targeted towards Australia’s workforce needs.

Occupations on the final list will reflect occupations as defined in the most recently updated Australian and New Zealand Standard Classification of Occupations (ANZSCO). The CSOL will determine which occupations are available for sponsorship under the proposed new Skills in Demand Visa. This new visa will have three tiers and most applications are expected to fall within the mid-tier Core Skills Stream (Tier 2). This tier will be for occupations with minimum earnings that fall between $70,000 to $135,000, which will be the minimum salary threshold for the Specialist Skills Stream (Tier 1).

The JSA has developed a Migration Labour Market Indicator Model which will be used in conjunction with stakeholder engagement, to provide advice to the Government. The new model and eventual CSOL will build on the Skills Priority List, and the initial consultation process which is now underway.

Mapien is finalising its submission to the JSA with a view to helping ensure the occupations which are critical to our clients remain on the new employer sponsored visa lists.

Takeaway

This is going to be a year of change with the Government undertaking thorough research on the labour market as it starts to form the policy settings for the new Skills in Demand Visa.

If you need advice on around sponsorship or your current visa cohort, please as always, reach out to us at Mapien.

This is blog #9 in our series on coaching models. Sign up to our mailing list to make sure you don’t miss out on our future content.

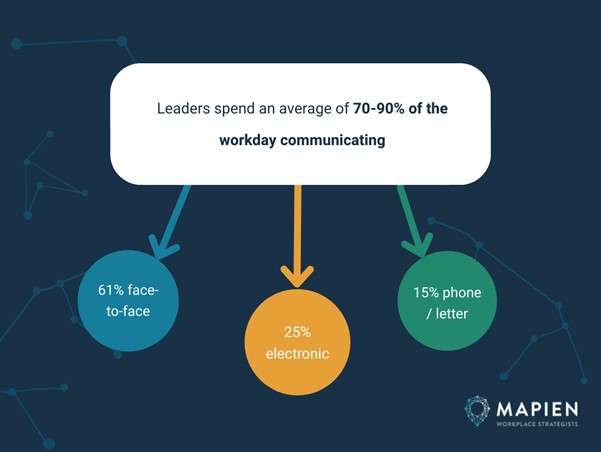

Did you know that as a leader, you likely spend anywhere from 70-90% of the work day communicating? If that figure seems like a lot, consider how much time you spend each day in meetings, emails, phone calls, and presentations. It quickly adds up!

One of the most powerful skills you can develop is your ability to communicate effectively — and not only because it occupies the bulk of your time. Good communication is essential for sharing your ideas and your vision, for building trust, and navigating change. On the other hand, poor communication can lead to project delays, failure, low morale, poor performance, and lost sales.

But what many people don’t realise is that good communication is so much more than delivering a clear message. You also need to get the channel right.

Why Choosing the Right Channel Matters

In a study that tracked how CEOs spend their time, they reported that 61% of communication was face-to-face, followed by 24% electronic (like email) and 15% by phone or physical mail.

But as a leader, how do you know what method of workplace communication is most appropriate for the message you need to deliver?

Choosing the right internal communication channel is easier said than done, with so many options available within a modern organisation, such as:

- One-on-one meetings

- Team meetings

- Video calls

- Phone calls

- Emails

- Intranet platforms

- Social media posts

- Messenger applications

Each of these channels has different strengths, weaknesses, and use cases. Choosing the right one is crucial to ensuring your message or communication campaign can achieve the desired outcomes.

8 Considerations for Choosing Your Communication Channels

In order to choose the right methods of communication, you need to match the content and intent of your message with the characteristics of the platform. So, we’ve come up with eight prompts to help you consider your message and your corporate communication channels.

1. How Urgent is the Message?

If you need your message to be seen or acted upon urgently, you’ll need to choose a channel to support that. For instance:

- If all relevant parties working in the same area, urgent messages may be delivered face-to-face

- If all relevant parties are not in the vicinity, it’s standard practice to use phone calls for urgent matters

Note that the opposite rule also applies. If your message is non-urgent, a phone call or unscheduled face-to-face meeting may be seen as disruptive or distracting.

2. Is One-Way or Two-Way Communication Appropriate?

Consider whether your message requires a response or further discussion when choosing your channels. Some communication channels are designed for one-way communication such as announcements or notifications. Other channels are designed to facilitate two-way communication, with features that encourage comments, feedback, and conversation.

Note that in most cases, it’s best to facilitate two-way communication because this shows that you’re open to ideas and listening to your stakeholders. Also, if you choose a channel that doesn’t allow for two-way communication, your stakeholders may still respond, but will choose whatever channel they prefer to reach you on, which can be harder to control or manage.

3. Is Your Goal to Influence People?

Sometimes you’ll need to deliver a message with the goal of influencing an outcome or encouraging buy-in. Generally speaking, if you’re trying to generate more influence and stronger commitments, you’ll have more success if you can deliver the message via face-to-face channels. Plus, face-to-face communication helps to build stronger relationships, ensures you don’t miss important feedback (such as non-verbal cues and social dynamics), and can help you build a more collaborative, engaging environment.

4. How Formal is the Communication?

It’s a good idea to match the level of formality of your message to the level of formality of the channel. You wouldn’t schedule a meeting ahead of time just to talk about what you did on the weekend — and you wouldn’t start a conversation about someone’s end-of-probation performance in the hallway.

You can use this strategically, too — the medium is the message. If you want someone to take you seriously, choose a more serious channel. If you want someone to perceive your message in a more casual way, deliver it in a casual manner.

5. Is the Message Sensitive or Confidential?

Some messages will be of a more sensitive nature or require confidentiality for legal reasons. As such, you’ll need to select a channel where you can control who sees or hears the message.

You should also keep in mind other potential audiences for your message. An obvious example is that a LinkedIn post aimed at internal audiences may also be seen by customers, competitors, future employees, and members of the public. But an internal email, message, or intranet post also has the potential to reach unintended audiences via forwarding or screenshots. For the most sensitive or confidential topics, a private face-to-face meeting is probably the safest option.

6. Will People Need to Refer Back?

Would it be useful for your message to be available for future reference? For example, does it contain useful information that’s relevant to a broader project, piece of work, or audience?

Messages, emails, and discussions are easily lost and forgotten. Instead, you may decide to publish the information as a video or written post in your company-wide intranet so that it’s easy to find and reference in future.

7. What is Your Workplace Communication Culture?

Another consideration is the broader communication culture within your workplace. For instance, are certain methods of communication more prioritised and valued over others? If so, these may be important channels through which to continue your communication, regardless of the message you deliver, any potential discomfort, or any logistical inconvenience.

A further cultural aspect is whether your organisation expects communication to occur at the same time (synchronous) or at different times (asynchronous) for different people. Based on this expectation, certain channels will be more suitable than others.

8. What Does Your Audience Prefer?

Each of the above considerations should be tempered with this final consideration: who are you trying to reach and what do they prefer or expect?

It’s always a good idea to ask your audience about their preferences, either directly or via a survey. And take note of how people respond to your communication via different channels — you’ll soon discover what works best for different audiences.

How to Select Your Channel

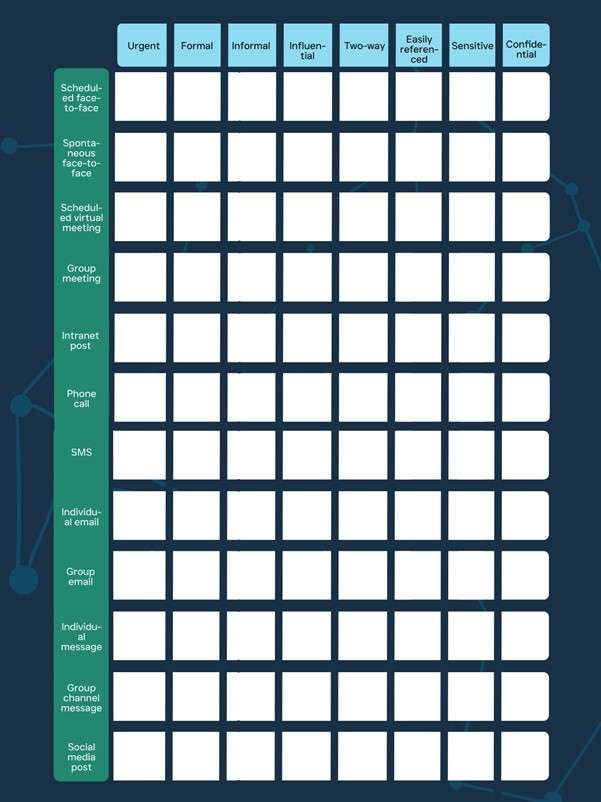

We’ve developed a simple model to help you work through the above considerations and hone in on the best channel for your message.

Step 1: Assess Your Channels

The first step to select a communication channel is to reflect on your options. What are the internal communication platforms and methods used in your workplace? And what are their characteristics?

You may like to use or recreate the above matrix template, placing a ✔ or ✖ in each square, based on the characteristics of each channel. This will allow you to see (at a glance) which channels are best suited to different messages and scenarios.

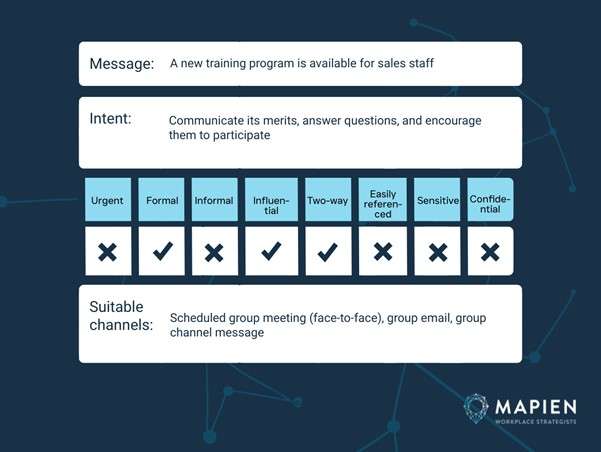

Step 2: What’s Your Message and Intent?

Now reflect on the message and intent of that message. Is it urgent? How formal is it? Does it need to influence people? Do you want to invite feedback or conversation? Will it be referred to in future? And are its contents sensitive or confidential?

Use the matrix from step 2 to determine which communication channels are most appropriate for your message, while keeping in mind your audience preferences and workplace culture.

Step 3: Reflection

After you’ve communicated your message, take some time to reflect on how it went. Was the message or campaign received as intended? What kind of feedback did you get? What would you do differently next time?

If the message wasn’t received as intended, you may need to update your matrix to more accurately reflect your workplace context so that you can choose a more appropriate channel in future.

Get Leadership and Coaching Support

One of the most powerful things you can do is to develop your skills and understanding in communication — especially since so much of your role as a leader is wrapped up in communicating with others.

By working through these considerations and steps identified above, you’ll be all set to confidently choose the right platform for each message.

We’ll be back soon with our final coaching model as we wrap up this series. In the meantime, you can reach out to our team for help with building leadership skills, leadership coaching, and more tools like this one.

Given that a hiring error can cost up to 21% of the mis-hire’s annual salary, the push towards accurate and dependable recruitment methods has never been more pertinent. The economic impact of bad hires has generated a shift towards psychometric testing marking a move towards more data-driven and analytical recruitment strategies. This approach aims to improve the efficiency and fairness of hiring processes, while also providing a more accurate prediction of a candidate’s future performance. As job roles become increasingly complex, and the need for adaptable and culturally aligned talent is more pronounced, psychometric testing offers valuable insights that go beyond traditional resumes and interviews, helping businesses reveal the true potential of their applicants.

Psychometric testing has become a key tool in modern recruitment, helping organisations match the right candidates with the right job roles more effectively. By assessing a candidate’s cognitive abilities, personality traits, and situational judgement, this approach provides a comprehensive view that goes beyond the traditional resume and interview process. It enables hiring managers to make decisions that are not only informed but also deeply aligned with the organisation’s culture and values.

What is psychometric testing?

Psychometric testing, put simply, is a scientific method used to measure individuals’ mental capabilities and behavioural style, offering a scientific approach to assess how well someone might fit a job role.

It evaluates intelligence, personality traits, and work preferences, giving a deeper insight into a candidate’s potential beyond what can be learned from resumes and interviews. The process is standardised, usually online, and includes a professional analysis of results. It’s a tool that adds depth to the hiring process, providing both employers and candidates with valuable insights.

Why are psychometric tests important in the hiring and recruitment process?

Finding the right candidate goes beyond just skill matching; it’s about ensuring a good fit with the company’s culture and values. Psychometric testing plays a key role in this process by providing objective, in-depth data on an individual’s compatibility with a role. This approach extends past the subjective judgments of interviews and the basic information from CVs, offering a more thorough understanding of a candidate’s capabilities and personality.

The strength of psychometric tests lies in its comprehensive and objective assessment. Evaluating crucial job-related skills and the less tangible, yet important, aspects of how a candidate might mesh with the team and the broader company culture. This helps to avoid costly hiring mistakes by offering insights into areas often overlooked by traditional hiring methods. Promoting fairness and equality by evaluating every candidate against the same standards, supporting inclusive hiring practices.

Psychometric testing differentiates itself by not just considering a candidate’s present qualifications but also by forecasting their potential to grow and succeed within the organisation. It’s about enhancing the recruitment process to make it more effective, ensuring new hires contribute positively to the team and company at large.

Enhanced Predictive Accuracy

Psychometric tests are scientifically designed to predict a candidate’s job performance by measuring their cognitive abilities and behavioural traits. This predictive power helps employers make more informed decisions, foreseeing how well a candidate will adapt to the role and contribute to achieving organisational goals.

Cultural Fit Assessment

A successful hire isn’t just about skills; it’s also about finding someone who aligns with the company’s culture. Psychometric testing provides an objective assessment of this fit, ensuring they’re likely to gel with the team and environment, which is key to long-term success.

Objective Evaluation

As many employers work towards eliminating bias and promoting diversity, psychometric tests offer an impartial method to assess candidates. By providing all applicants with the same set of questions and evaluating them based on standardised criteria, these tests help level the playing field and reduce unconscious bias in the selection process.

Streamlined Recruitment Process

Incorporating psychometric assessments can streamline the recruitment process, identifying the most suitable candidates early on. This efficiency reduces the time and resources spent on interviewing unsuitable candidates and can significantly lower the costs associated with turnover and rehiring.

Development and Retention

Psychometric tests not only aid in the hiring process but also in the development and retention of employees. Understanding an individual’s strengths and areas for improvement can guide personalised development plans, enhancing job satisfaction and employee retention rates.

Psychometric testing enriches the recruitment and selection process by providing a comprehensive, unbiased view of a candidate’s potential. These assessments bridge the gap between a candidate’s present qualifications and their future performance and fit within the company, making them an invaluable tool in the modern hiring landscape.

What are the benefits of psychometric testing?

The benefits of psychometric testing extend well beyond the initial selection and hiring phases, offering long-term advantages for both employers and candidates. By utilising these assessments, organisations can not only refine their recruitment strategies but also enhance their overall workplace environment.

For Employers

Improved Hiring Quality

Psychometric testing contributes to a higher quality of hire by ensuring that candidates’ abilities and personality traits align with the job requirements and company culture. A study published in the Journal of Intelligence found that cognitive ability tests are strong predictors of job performance across the vast majority of occupations, significantly improving hiring outcomes.

Cost Efficiency

The cost of a bad hire can be substantial, including wasted salary, training expenses, and decreased team productivity. Psychometric testing helps mitigate these risks by providing an additional layer of screening. According to the Society for Human Resource Management (SHRM), the average hard costs for hiring is $4,700, but with employers estimating the true figure to actually be up to three to four times the position’s annual salary for replacing a bad hire. By reducing turnover through more informed hiring decisions, companies can save significant resources in the long run.

Enhanced Team Dynamics

By assessing personality traits and work preferences, psychometric tests can aid in assembling high-performance teams that are more cohesive and effective. This alignment can improve team dynamics, foster a positive work environment, and increase overall productivity.

Data-Driven Decisions

These tests transform hiring from a subjective art into a more objective science, allowing employers to make decisions based on quantifiable data. This shift not only bolsters the fairness of the recruitment process but also supports diversity and inclusion by minimising unconscious biases.

For Candidates

Fair Assessment

Candidates benefit from a level playing field where they are assessed based on their actual abilities and potential, rather than on resume credentials or the ability to perform in an interview alone. This fairness can increase the attractiveness of an employer to prospective job seekers.

Personal Insight

Even if not selected for a role, candidates can gain valuable insights into their strengths and areas for improvement through psychometric testing feedback. This feedback can be instrumental in personal development and future job searches.

Better Job Fit

For candidates, being selected through a process that includes psychometric testing often leads to better job satisfaction. This is because the role is more likely to align with their skills, personality, and work preferences, reducing the likelihood of early departure.

Types of psychometric tests

Psychometric assessments and testing can be broadly categorised into three main types: personality tests, ability tests, and behavioural/skill based assessments (including situational judgement tests). Each type plays an important role in evaluating different elements of a candidate’s profile, offering comprehensive insights into their potential suitability for a role.

Personality Tests

Personality tests delve into the nuances of an individual’s character, behaviour, and preferred work style, assessing traits like extraversion, agreeableness, openness, conscientiousness, and emotional stability. The Myers-Briggs Type Indicator (MBTI), for instance, categorises people into 16 distinct personality types, reflecting different ways individuals perceive the world and make decisions, and along with other ‘type’ based assessment provides incredible insight for existing teams to be able to maximise their effectiveness as a team. Similarly, the Big Five Personality Traits model evaluates individuals across five major dimensions of personality with a stronger and more scientifically accurate ‘trait’ based approach to assessing personality, proving invaluable for employers looking to gauge a candidate’s potential fit within a team, their adaptability to the company’s culture, and their approach to facing workplace challenges. This makes personality assessments particularly crucial for roles necessitating significant interpersonal interaction or a specific type of personality alignment.

Ability Tests

Also known as aptitude tests, ability assessments measure a candidate’s cognitive capabilities, shedding light on their potential to undertake tasks and navigate problem-solving scenarios effectively. These tests range from general assessments to more specific ones targeting verbal reasoning, numerical ability, logical reasoning, and spatial awareness. For example, Raven’s Progressive Matrices test logical reasoning while the Numerical Reasoning Test gauges numerical ability. Through these assessments, employers can identify candidates with the analytical prowess, quick learning skills, and the ability to manage complex information, making such tests indispensable for positions that require robust analytical and problem-solving skills.

Behavioural/Skill Based Assessments

This type of assessment, which includes the broad category of Situational Judgement Tests (SJTs), can take the approach of placing candidates in hypothetical, job-related scenarios, asking them to choose or rank the most effective responses. Commonly in testing for recruitment and selection this includes Emotional Intelligence tests, Situational Safety Awareness tests, sales skills, interpersonal skills, and more. When tailored to specific job roles, these tests assess judgement, decision-making abilities, and how well a candidate’s skills and knowledge translate into practical, on-the-job situations. Whether it involves managing a challenging customer service issue or resolving conflict within a team, skill based tests and SJTs provide a lens into how candidates apply their judgement and decision-making skills in real-world contexts. This aspect of psychometric testing is especially relevant for roles that prioritise leadership, decision-making, and interpersonal skills, offering a window into how a candidate might perform in critical, everyday work scenarios.

The Debate Around Psychometric Testing in Recruitment

The use of psychometric testing in recruitment often sparks debate, especially concerning its impact on diversity, equity, and inclusion (DE&I). Research suggests that these tests can inadvertently disadvantage candidates across racial or minority groups and those with disabilities or mental health conditions, potentially undermining efforts to foster a diverse and inclusive workforce. The concern lies in the fact that standard tests may not accurately reflect the abilities of individuals with certain disabilities or mental health issues, thereby skewing results and limiting opportunities for these candidates.

Acknowledging these complexities does not diminish the value of psychometric evaluations in creating inclusive hiring frameworks. Rather, it highlights the necessity for a thoughtful approach in their application. With careful planning and consideration, psychometric assessments can be adapted to accommodate a wide range of candidates, ensuring fairness and accessibility. For instance, adjustments can be made to the testing environment or to the tests themselves, such as allowing extra time for individuals with specific needs or providing alternative formats for those with sensory impairments.

By integrating psychometric testing with a broader suite of assessment methods you can further mitigate potential biases. This holistic approach to candidate evaluation ensures that decisions are not solely based on test results but are informed by a comprehensive understanding of each individual’s skills and potential.

Preparing for a Psychometric Test

Facing a psychometric test can seem daunting, but with the right preparation, candidates can approach these assessments with confidence. Here are some general tips and strategies to help navigate the process:

- Familiarise Yourself: Understand the types of questions and formats you might encounter. Many test publishers provide practice tests or sample questions.

- Practice Regularly: Engaging with practice materials can improve your speed and accuracy under test conditions.

- Review Basic Skills: Depending on the test, brushing up on basic maths, reading comprehension, or logical reasoning skills can be beneficial.

- Rest and Relaxation: Ensure you’re well-rested and mentally prepared on the day of the test. A clear mind performs better.

- Mindset and Attitude: Approach the test with a positive attitude. Remember, psychometric tests are designed to assess fit, not to trick you.

- Avoid Distractions and Interruptions: Make sure you are not going to be interrupted when doing the testing – especially when working with timed tests.

- Time Management: Practise managing your time effectively, especially for timed tests. Learn to move on from questions you find difficult and return to them if time allows.

- Ask for Accommodations: If you have a disability or require special conditions to perform your best, don’t hesitate to request the necessary accommodations from the employer in advance.

For employers, guiding candidates on how to prepare for psychometric tests is crucial for a fair and effective assessment process. Encourage candidates to:

- Provide Specifics: Whenever possible, give candidates specifics about the test they will be taking (e.g., the type of test, duration, and format) without compromising the integrity of the assessment. This helps reduce test anxiety and allows candidates to prepare effectively.

- Communicate Needs: Remind them to inform you of any special accommodations they might need as early as possible. This ensures that all candidates have an equal opportunity to showcase their abilities.

- Utilise Available Resources: Direct them to any official practice tests or preparation guides that are available.

- Offer Practice Sessions: If feasible, provide a practice session or orientation to the testing environment. This can help demystify the process and make candidates more comfortable.

- Reassure About the Process: Ensure candidates understand that the test is just one part of the overall assessment process. Encourage them to give their best but to also not be overly stressed about the outcome.

- Feedback Opportunity: Let candidates know if and how they will receive feedback on their performance. Understanding their own strengths and areas for development can be valuable, regardless of the outcome.

Implementing Psychometric Tests in Your Hiring Process

Integrating psychometric tests into your organisation’s hiring process can significantly enhance your recruitment strategy by offering deeper insights into candidates’ abilities and fit.

Here is a quick step-by-step guide to help you implement psychometric testing in your recruitment efforts:

Step 1: Define Your Objectives

Start by clarifying what you aim to achieve with psychometric testing. Are you looking to assess cognitive abilities, personality traits, or specific skills? Understanding your objectives will guide you in selecting the most appropriate tests.

Step 2: Select Appropriate Tests

Select tests that are scientifically validated and relevant to the job role and your organisational culture. Consider working with reputable test providers who can offer guidance based on your specific needs. Ensure the tests comply with local laws and regulations regarding employment testing.

Step 3: Develop a Testing Policy

Develop a clear policy outlining the role of psychometric testing in your recruitment process. This should include who will be tested, at what stage of the recruitment process, and how the results will be used. Communicate this policy to all stakeholders to ensure transparency and fairness.

Step 4: Equip Your Team

Ensure your hiring team is trained not only in administering the tests but also in interpreting the results accurately. Understanding the nuances of test outcomes is crucial for making informed hiring decisions. Training should also cover ethical considerations and legal compliance.

Step 5: Administer the Tests

Modern tests are generally administered online, except for in special circumstances. Consider the candidate experience, ensuring that instructions are clear and that the testing environment is conducive to optimal performance. When administering tests online, verify the technical requirements and support available for candidates.

Step 6: Interpret Results with Expertise

Interpreting test results requires a nuanced understanding of what they signify in the context of the job and your organisation’s culture. Combine the insights from psychometric testing with other elements of your recruitment process, such as interviews and reference checks, for a holistic view of each candidate, with support from your psychometric provider if possible.

Step 7: Provide Constructive Feedback

Offering feedback to candidates about their test results can be beneficial for their professional development. Decide on the format and extent of feedback you will provide and ensure it is delivered in a constructive and respectful manner.

Step 8: Continuously Evaluate and Adjust

Regularly review the effectiveness of psychometric testing in your hiring process. Seek feedback from candidates and hiring managers, and assess whether the tests are helping you meet your recruitment objectives. Be prepared to adjust your strategy and test selection as needed.

Additional Considerations:

- Ethical and Legal Compliance: Ensure the tests are fair, unbiased, and comply with employment laws.

- Candidate Experience: Consider the impact of testing on the candidate experience. Clear communication and respect for candidates’ time and privacy are essential.

- Integration with Other Assessment Methods: Psychometric testing should complement, not replace, other assessment tools and interviews. A multi-faceted approach ensures a more accurate evaluation of candidates.

- Data Security: Protect candidates’ test results and personal information in accordance with privacy laws and best practices.

Leveraging the expertise of a consulting firm can not only simplify the selection and implementation of psychometric tests but also ensure adherence to best practices and legal compliance. A consultant can help design a testing process that is respectful of candidates’ time and privacy, enhancing your employer brand.

Integrating psychometric tests into your recruitment process reaches its full potential when it complements a broader, holistic assessment strategy. At Mapien, our expertise lies in aligning these tests effectively with other evaluation methods, providing a comprehensive view of each candidate’s capabilities. With our support, you can ensure psychometric assessments enhance your existing recruitment practices, leading to more informed and balanced hiring decisions. Get in touch with our team to discuss how we can help.

Over to you

Integrating psychometric testing into your recruitment process is about making smarter hiring decisions, where insights into a candidate’s abilities and fit are clear and actionable. It’s a strategy that moves beyond the resume, tapping into the deeper potential of applicants to ensure they align with your company’s goals and culture. This approach not only streamlines the hiring process but also supports building a diverse and dynamic team poised for success.

Mapien specialises in making this integration seamless, with expertise in selecting, administering, and interpreting psychometric tests that match your specific organisational needs. We’re here to ensure that your recruitment strategy is not just effective but also inclusive and forward-thinking. Learn how Mapien can help transform your approach to hiring with psychometric assessments.

Explore psychometric testing further with our white papers. Enhance your recruitment process with strategic hiring.

FAQs

How reliable are psychometric tests in predicting job performance?

Psychometric tests are designed to be highly reliable, with many tests undergoing rigorous scientific validation to ensure they accurately measure the traits they claim to. However, the predictive validity of these tests can vary based on the job role, the specific test used, and how results are interpreted in conjunction with other hiring methods.

Can psychometric testing be biased?

Like all assessment methods, psychometric tests can have potential biases. Test developers work to minimise these biases by ensuring the tests are culturally neutral and by regularly reviewing the test content. Employers can further reduce bias by using tests as part of a holistic assessment strategy, rather than as the sole basis for hiring decisions.

Are psychometric tests legally allowed in the recruitment process?

Yes, psychometric tests are legally allowed in the recruitment process, provided they are used ethically and in compliance with local employment laws. Tests must be relevant to the job and used in a way that does not discriminate against candidates based on race, gender, age, or other protected characteristics.

Can psychometric test results be challenged by candidates?

Candidates can request feedback on their test results and how they were interpreted in the context of the hiring decision. While challenging the results might not change the outcome of a particular recruitment process, constructive feedback can provide valuable insights for personal development.

Connect with us

If you would like to learn more, please reach out and one of our Workplace Strategists will be in touch within 24 hours.

We are standing at the precipice of a new world of work. I say this in the sense that soon, we could very well end up living in a country, where going to work is a pleasant and engaging experience as the rule, not the exception. Or at least, we possibly could be.

Legislative changes and their implications

Over the past two years, the Australian federal government has undertaken legislative changes in our anti-discrimination, and workplace health and safety laws. These changes are meaningful: employers across the country now have an obligation to proactively ensure that their workplaces and roles do not pose a risk to the psychological health and safety of their workers, in the same way that they are obligated to protect their workers from physical harm. This is a monumental change in the fortunes of workers across Australia, and is something that now needs to be considered and acted upon by every single leader in Australia.